VATWatch - March 2025

Promoting electronic invoicing across UK businesses and the public sector

HMRC and the Department for Business and Trade (DBT) are publishing a joint consultation to understand how e-invoicing may align with you or your customers’ businesses. The aim is to better understand the potential impact of standardising electronic invoicing and increasing its adoption across UK businesses and the public sector. They are interested in responses from businesses of all sizes. So, whether you use e-invoicing or not, you’re an interest group, representative body, industry body or an individual, your opinion is welcome.

The consultation is now open and closes on the 7th May 2025. You can respond on-line or by emailing a dedicated HMRC email address.

If you would like me to pass your thoughts on as part of the VAT Practitioners’ Group response, just let me know.

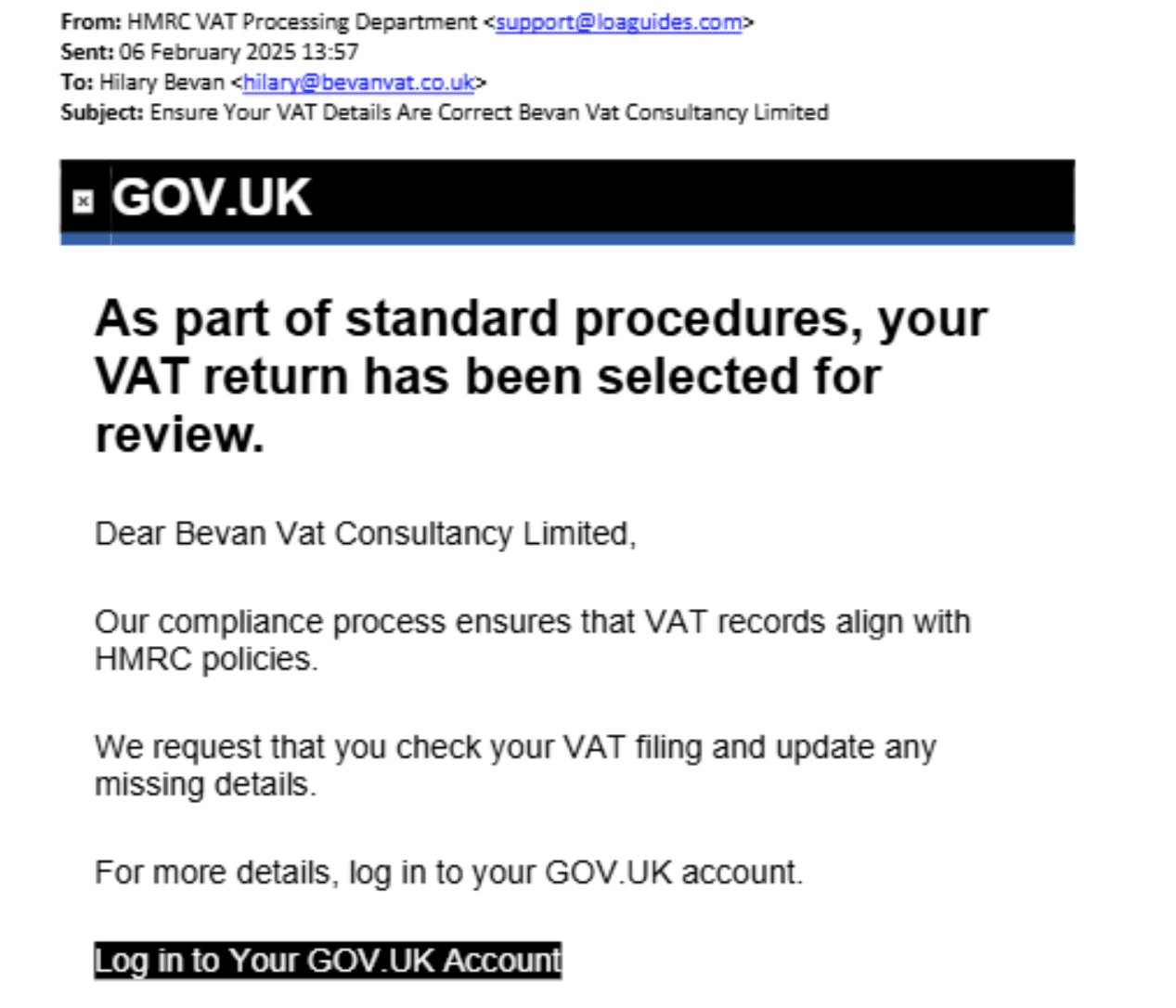

Scam Aware

Thank you for taking the time to read this VATwatch round-up.